Contents

Summary

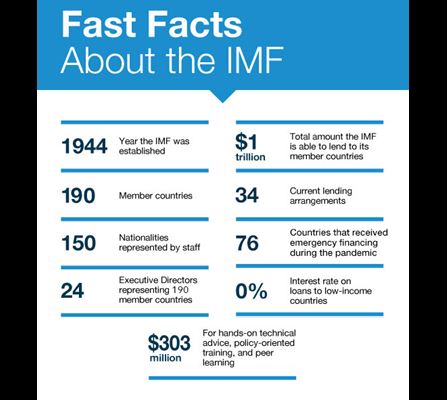

International Monetary Fund is an organization striving to promote global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.

International Monetary Fund was created in July 1944, when deputies of 45 countries meeting in the town of Bretton Woods, New Hampshire, in the northeastern United States, accepted a framework for international economic cooperation, to be established after the Second World War. These representatives believed that such a framework was necessary to avoid a repetition of the disastrous economic policies. It came into formal existence in December 1945, when its first 29 member countries signed its Articles of Agreement.

Mission

International Monetary Fund’s primary objective is to help secure stability in the international system. It does that in various ways: keeping track of the global economy and the economies of member countries; lending to countries with balance of payments difficulties; and giving practical help to members.

Globalization: Globalization affects countries’ policy choices in many ways, including labor, trade, and tax policies. While bypassing potential disadvantage, International Monetary Fund helps countries to profit from globalization.

International Monetary Fund backs its member countries by providing: policy advice to governments and central banks based on analysis of economic trends and cross-country experiences; research, statistics, forecasts, and analysis based on tracking of global, regional, and individual economies and markets; loans to help countries overcome economic difficulties; concessional loans to help fight poverty in developing countries; and technical assistance and training to support countries improve the management of their economies.

History

The IMF was originally set up in 1945 as part of the Bretton Woods Agreement, which strived to encourage international financial partnership by proposing a system of convertible currencies at fixed exchange rates, with the dollar redeemable for gold at $35 per ounce.

The IMF also acted as a gatekeeper.

Since the Bretton Woods system crumbled in the 1970s, the IMF has promoted the system of floating exchange rates, meaning that market forces determine the value of currencies relative to one another. This remains true today.

Leadership and member countries

Board of Governors

The Board of Governors consists of one governor and one alternate governor for each member country. Each member country delegates its two governors. The Board usually meets once a year and is capable of electing or appointing executive directors to the Executive Board.

Responsibilities: approving quota increases, special drawing right allocations, the admittance of new members, compulsory withdrawal of members, and amendments to the Articles of Agreement and By-Laws, in practice it has delegated most of its powers to the IMF’s Executive Board

The Board of Governors is guided by the International Monetary and Financial Committee and the Development Committee. T

The Board of Governors reports to the Managing Director of the IMF, Kristalina Georgieva.

Executive Board

24 Executive Directors make up the Executive Board. The Executive Directors represent all 189 member countries in a geographically based roster.

Managing Director

The IMF is supervised by a managing director, who is head of the staff and serves as Chairman of the Executive Board.

Loan conditions

Some of the conditions are as follows:

1. Cutting expenditures, also known as austerity.

2. Focusing economic output on direct export and resource extraction,

3. Devaluation of currencies,

4. Trade liberalisation, or lifting import and export restrictions,

5. Increasing the stability of investment (by supplementing foreign direct investment with the opening of domestic stock markets),

6. Balancing budgets and not overspending,

7. Removing price controls and state subsidies,

8. Privatization, or divestiture of all or part of state-owned enterprises,

9. Enhancing the rights of foreign investors vis-a-vis national laws,

10 Improving governance and fighting corruption.

These conditions are known as the Washington Consensus.

Benefits

These loan conditions guarantee that the borrowing nation will be able to reimburse the IMF.

Climate change

Like the IMF says in a report on climate change:

Global warming has become a clear and present threat. Actions and commitments to date have fallen short. The longer we wait, the greater the loss of life and damage to the world economy. Finance ministers must play a central role to champion and implement fiscal policies to curb climate change. To do so, they should reshape the tax system and fiscal policies to discourage carbon emissions from coal and other polluting fossil fuels.

The Fiscal Monitor helps policymakers choose what to do and how to do it, right now, globally and at home.

Governments will need to increase the price of carbon emissions to give people and firms incentives to reduce energy use and shift to clean energy sources. Carbon taxes are the most powerful and efficient tools, but only if they are implemented in a fair and growth-friendly way.

The publication is the first major report under incoming Managing Director Kristalina Georgieva, former head of the World Bank, who said Tuesday that climate change is “a crisis where no one is immune and everyone has a responsibility to act.”

“Global warming is threatening our planet and living standards around the world, and the window of opportunity for containing climate change to manageable levels is closing rapidly,” IMF analysts wrote. “Action to date has been inadequate.”

Criticism

Like Mark Weisbrot recently reported in the Guardian:

“To see what the problem looks like, consider a recent IMF loan. In March, Ecuador signed an agreement to borrow $4.2bn from the IMF over three years, provided that the government would adhere to a certain economic program spelt out in the arrangement. In the words of Christine Lagarde – then the IMF chief – this was “a comprehensive reform program aimed at modernizing the economy and paving the way for strong, sustained and equitable growth”.

The program calls for an enormous tightening of the country’s national budget – about 6% of GDP over the next three years. In Ecuador, this will include firing tens of thousands of public sector employees, raising taxes that fall disproportionately on poor people, and making cuts to public investment.

The overall impact of this large fiscal tightening will be to push the economy into recession. Unemployment will rise – even the IMF program projections acknowledge that – and so will poverty.”

References

- https://www.crunchbase.com/organization/international-monetary-fund#section-overview

- https://blogs.imf.org/2019/10/10/fiscal-policies-to-curb-climate-change/

- https://en.wikipedia.org/wiki/International_Monetary_Fund

- https://www.theguardian.com/commentisfree/2019/aug/27/imf-economics-inequality-trump-ecuador

- https://www.investopedia.com/terms/i/imf.asp

- https://www.bloomberg.com/news/articles/2019-10-10/imf-urges-action-on-climate-crisis-as-paris-accord-falls-short